the motivation

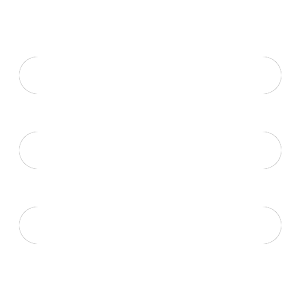

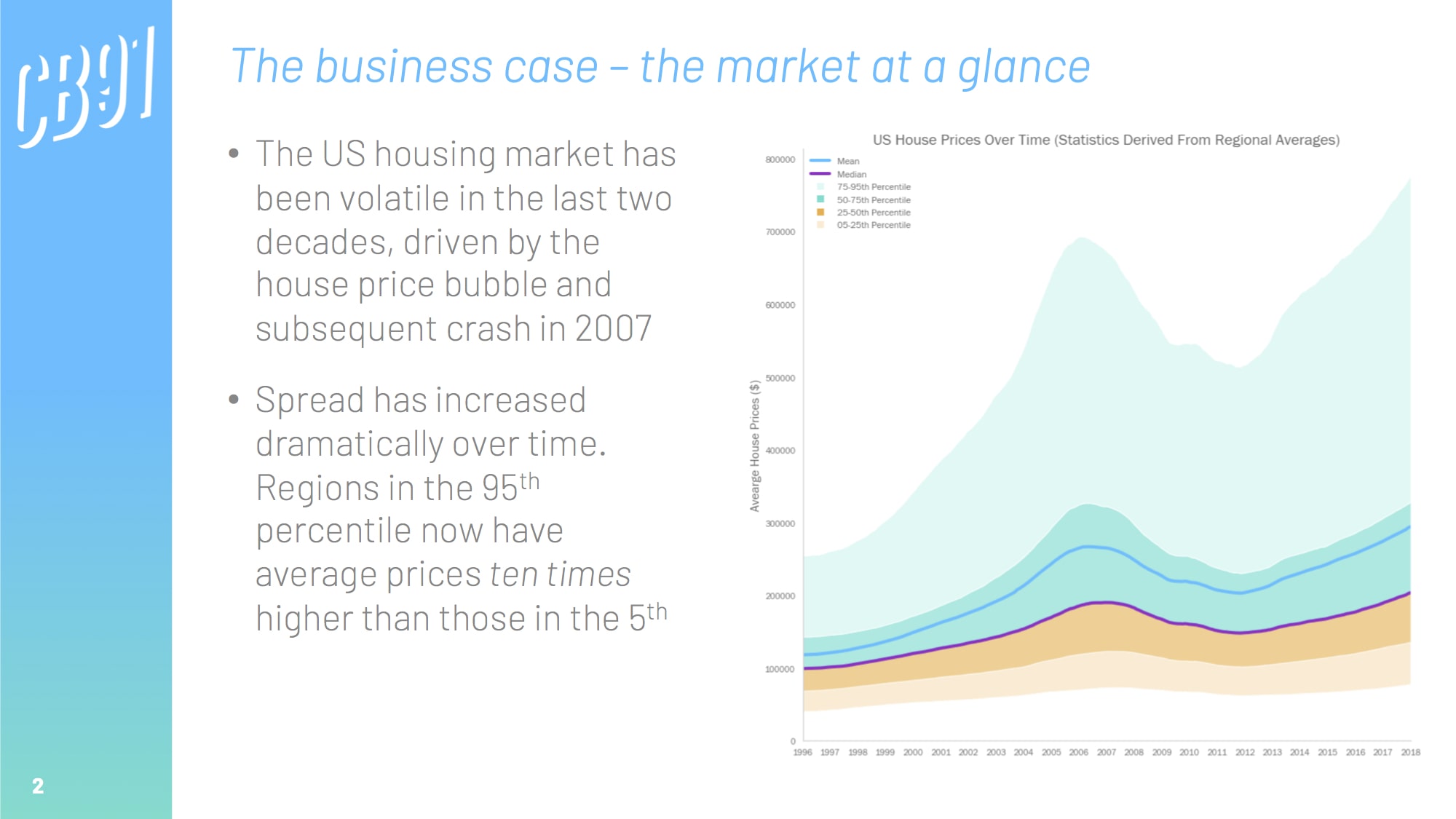

Property has the potential to be an incredibly lucrative investment. Buying houses in the fastest growing areas in America between 1996-2018 could have given returns of up to 4,000% - massively outperforming pretty much any stock.

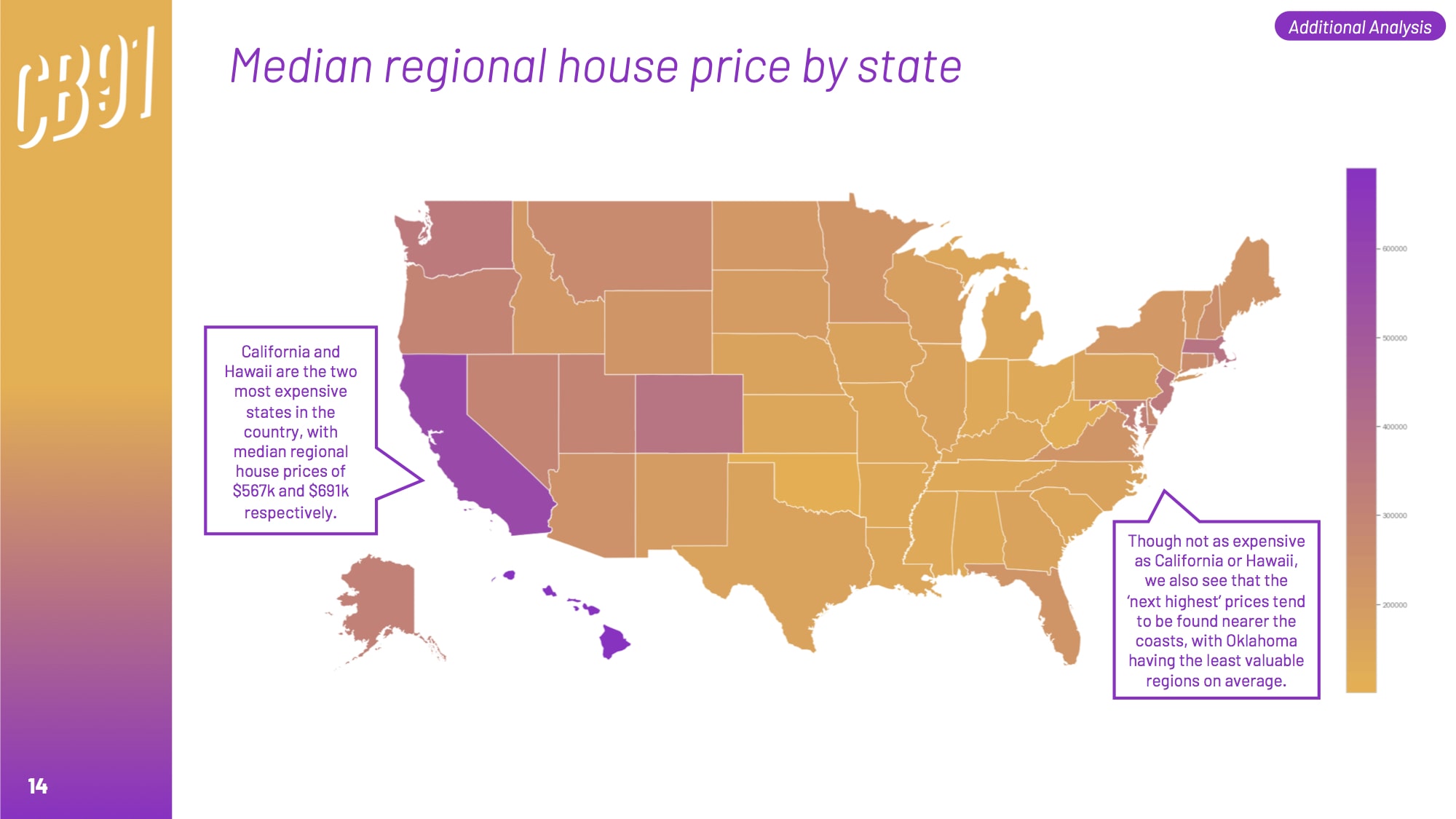

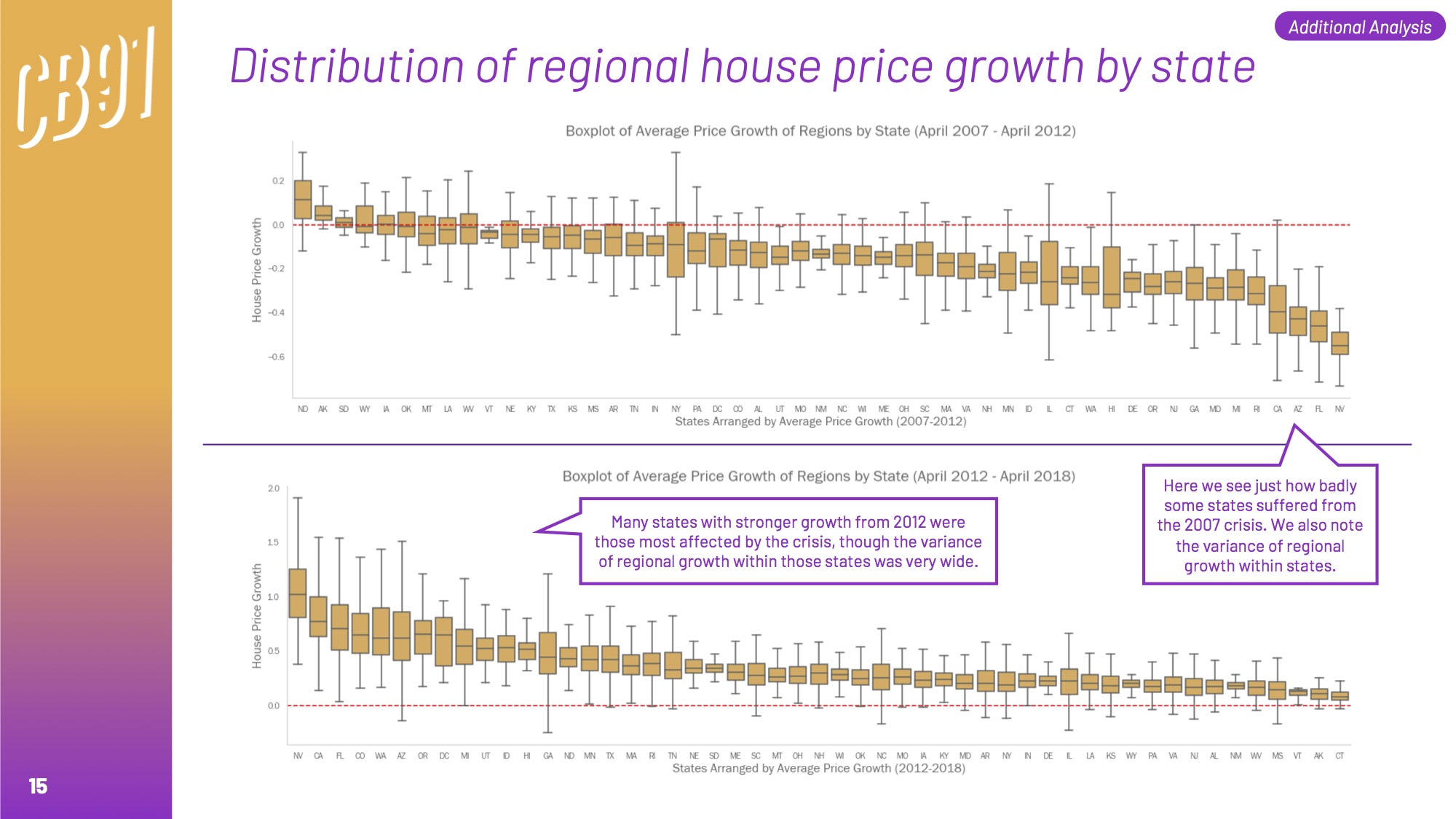

However, property investments have the potential to be financially ruinous. Just ask anyone who bought a house in Florida just before the financial crisis. If we're going to invest in property successfully, accurately forecasting house prices by area should allow us to better pick winners, and avoid bear traps.

the approach

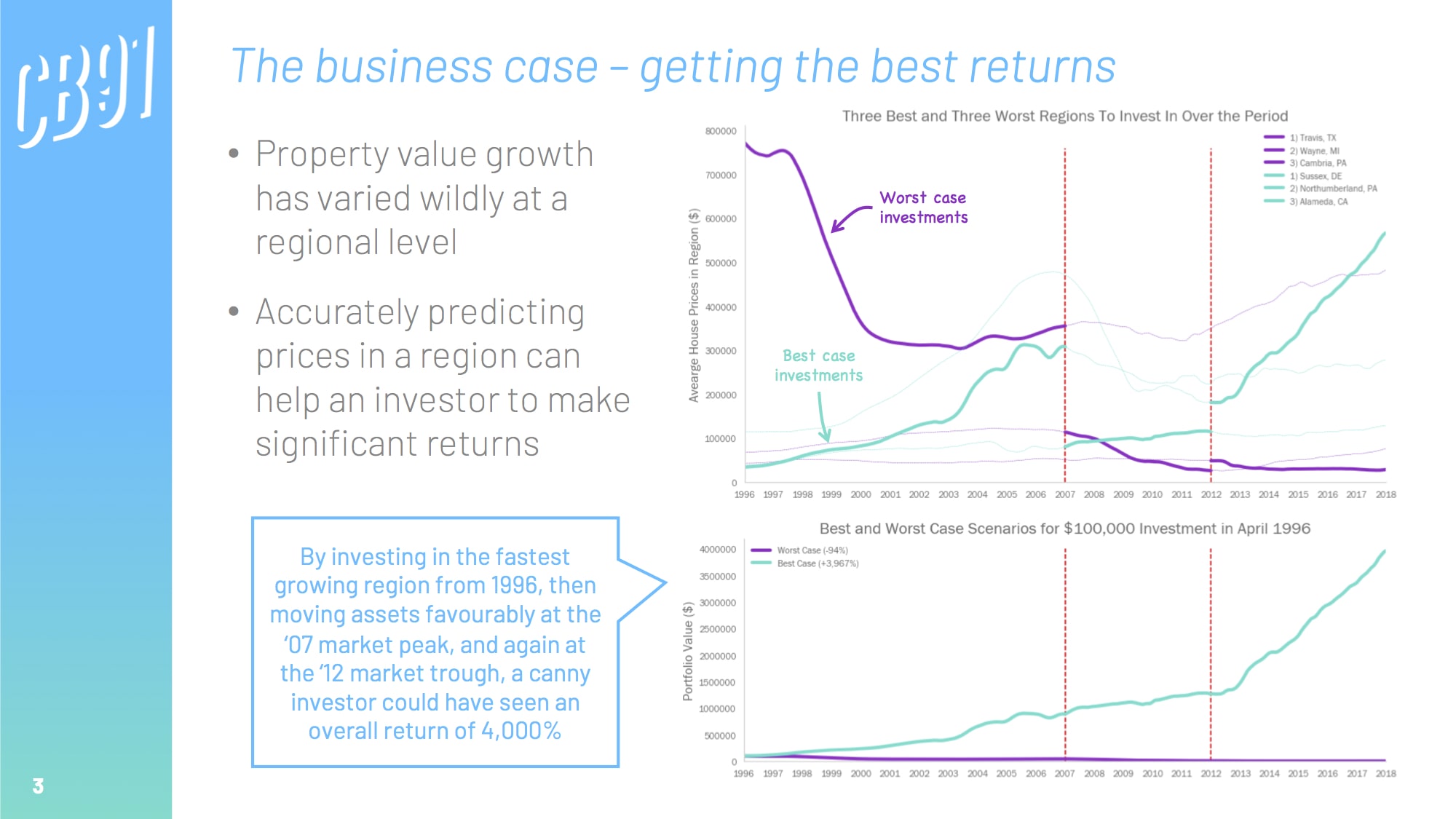

If we want to recommend regions in America for someone to invest in property, we should seek to maximise their returns, whilst also mitigating risk. We can do this by recommending:

- A 'portfolio' of five different ZIP codes to invest in

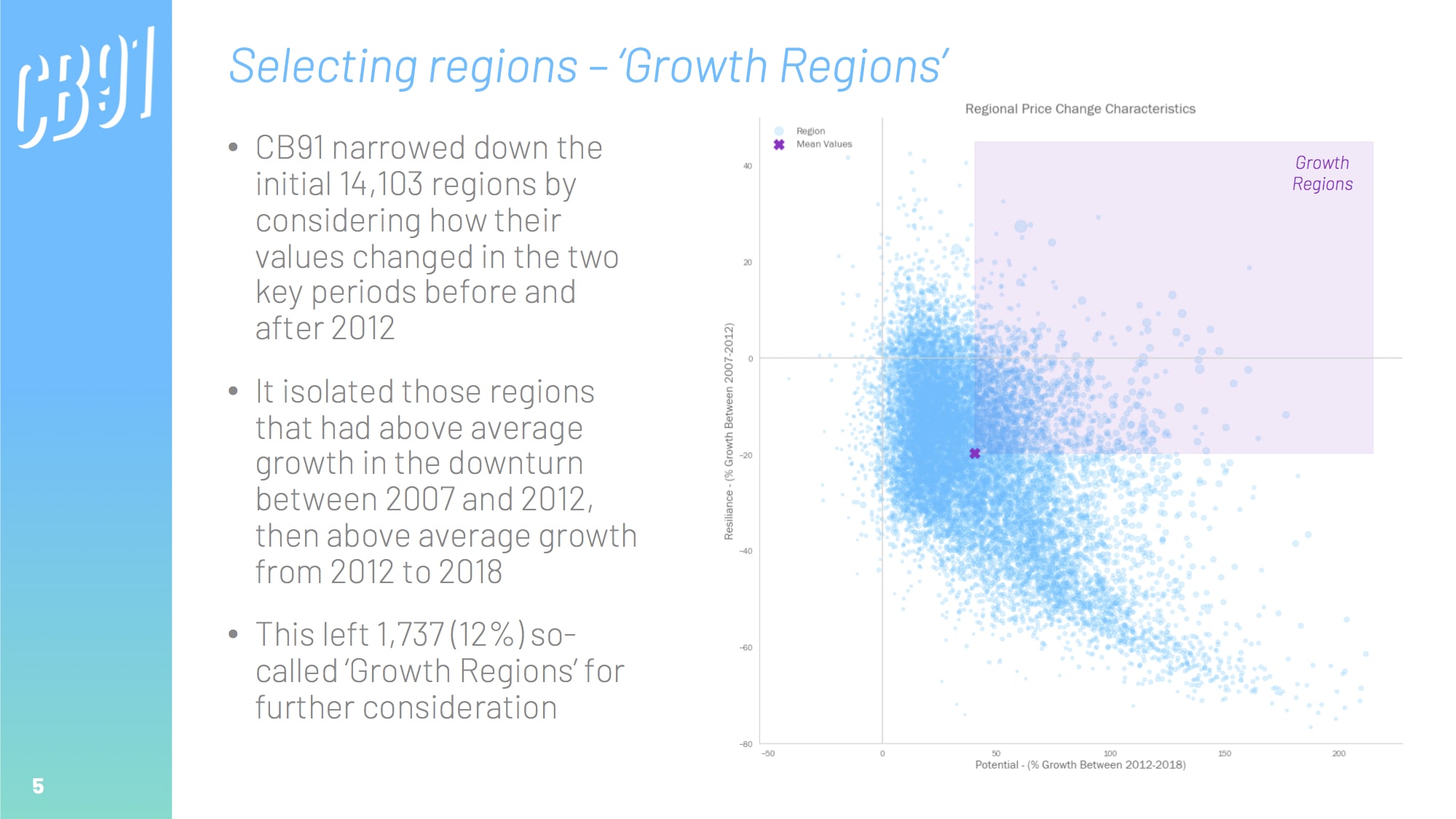

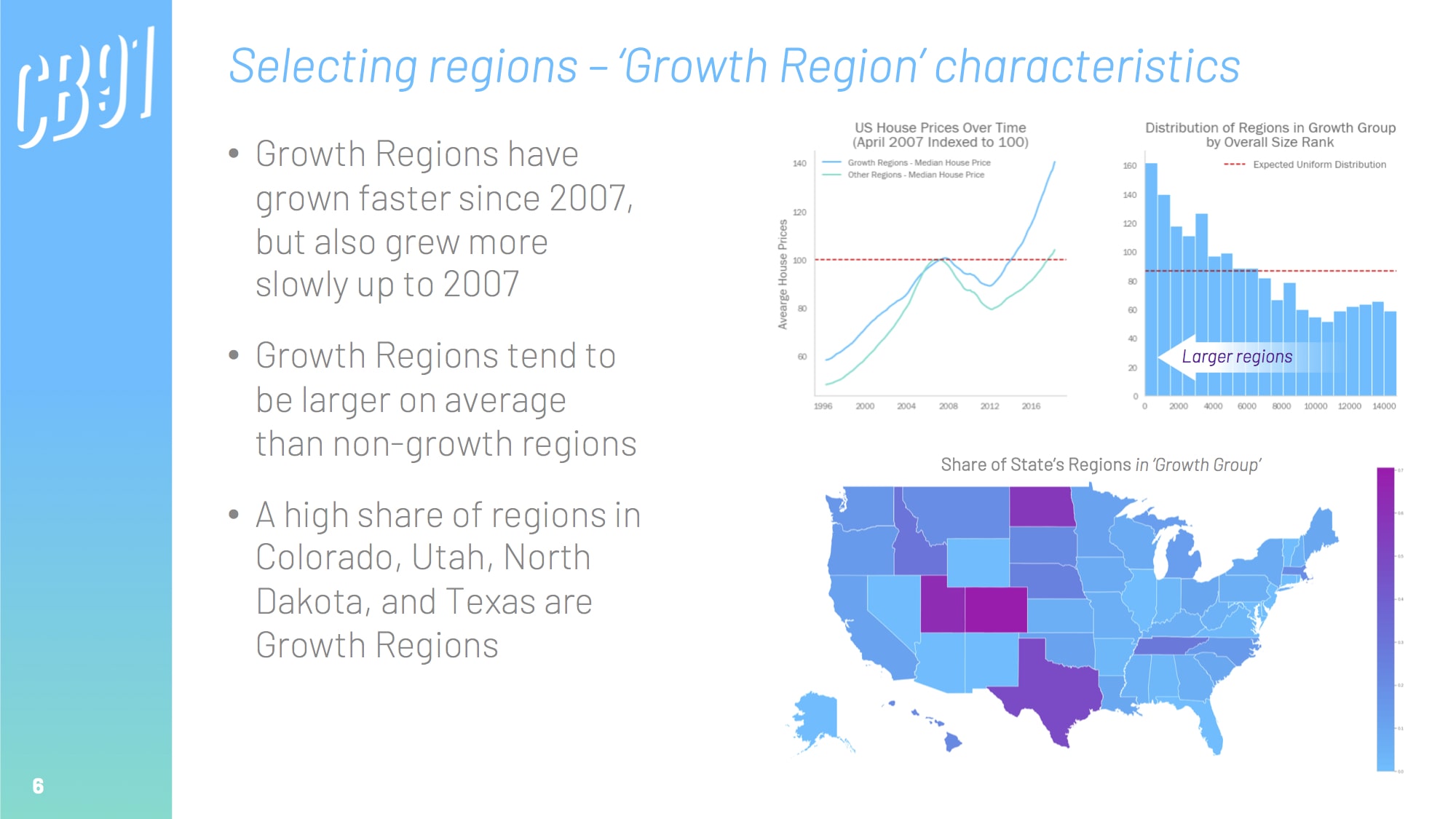

- Areas that had above average price growth both during and since the financial crisis (thus isolating areas resilient to downturns and those also able to benefit from spells of economic growth)

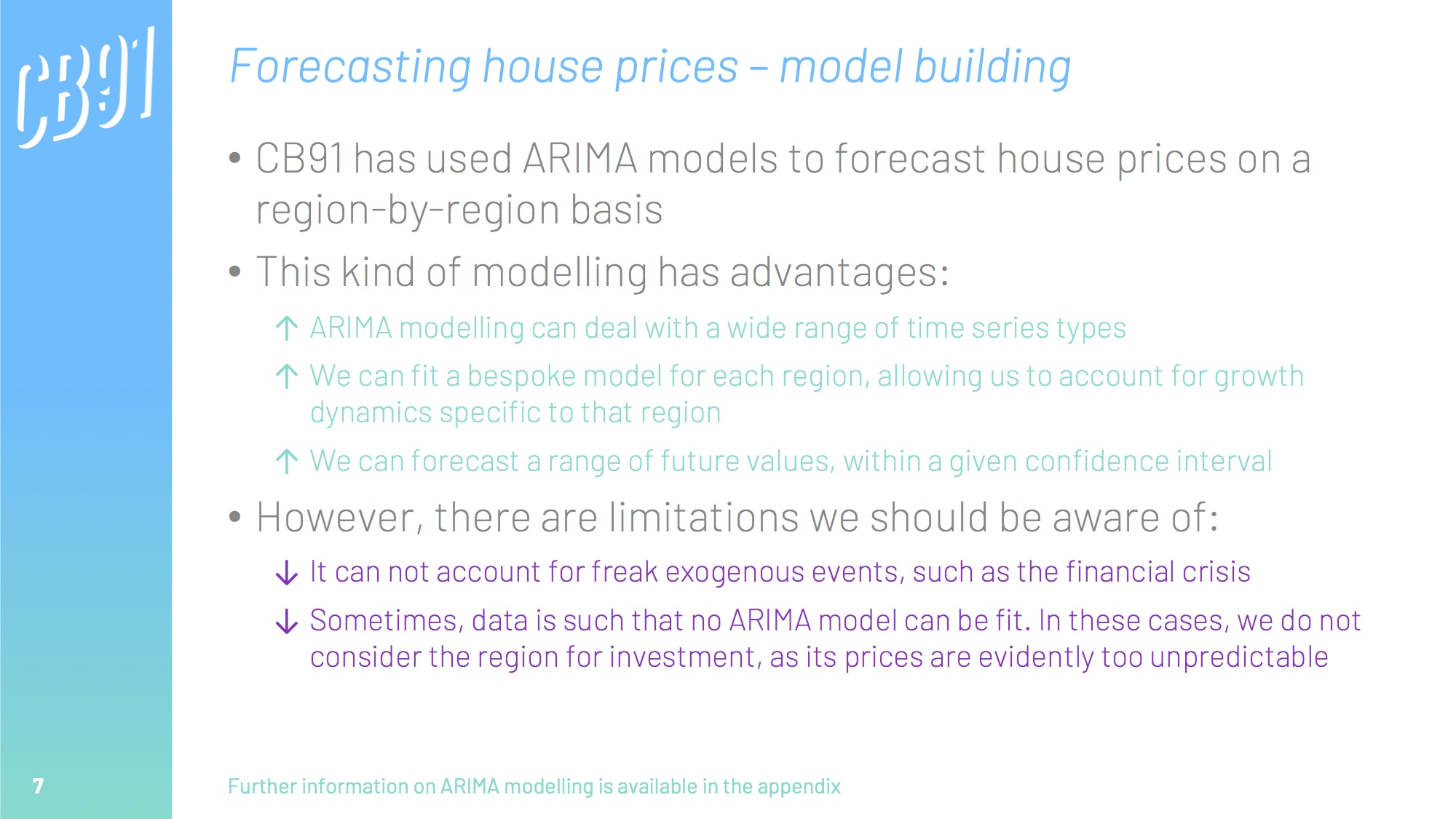

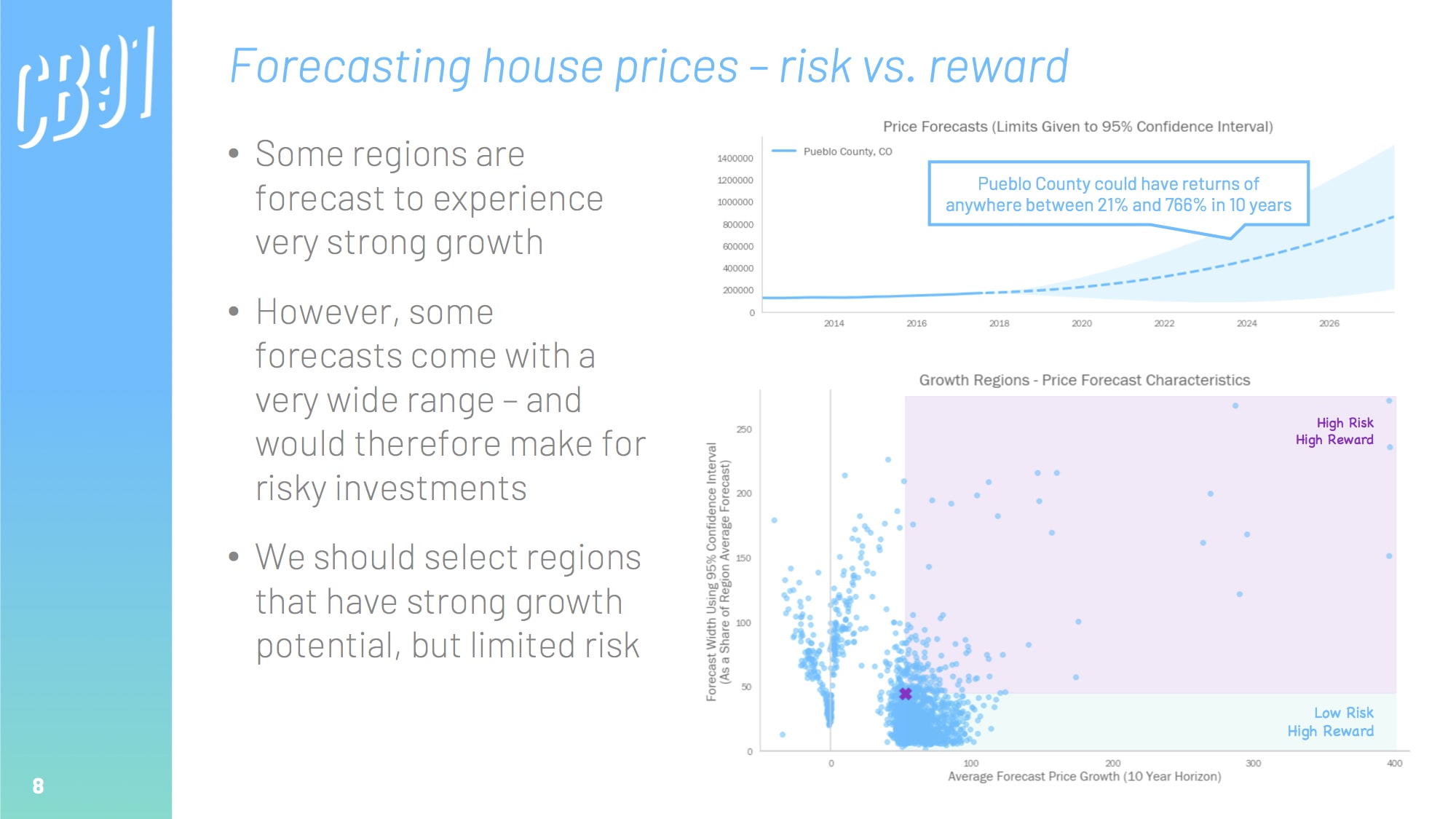

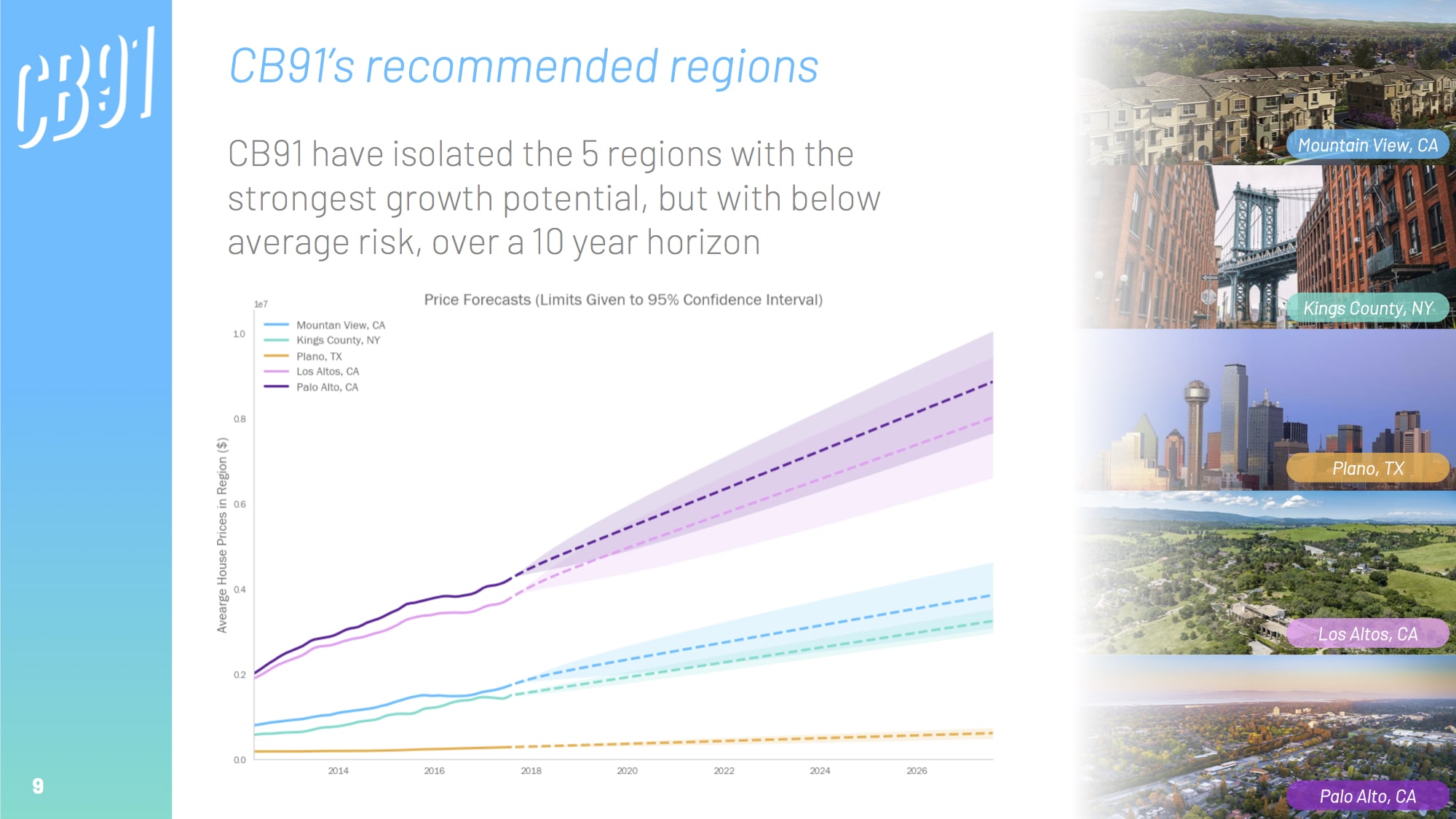

Given access to historical house price data (from Zillow) we can create median house price forecasts at a ZIP code level, using bespoke ARIMA models for each area. We then look at which five areas give the best returns over a ten year horizon.

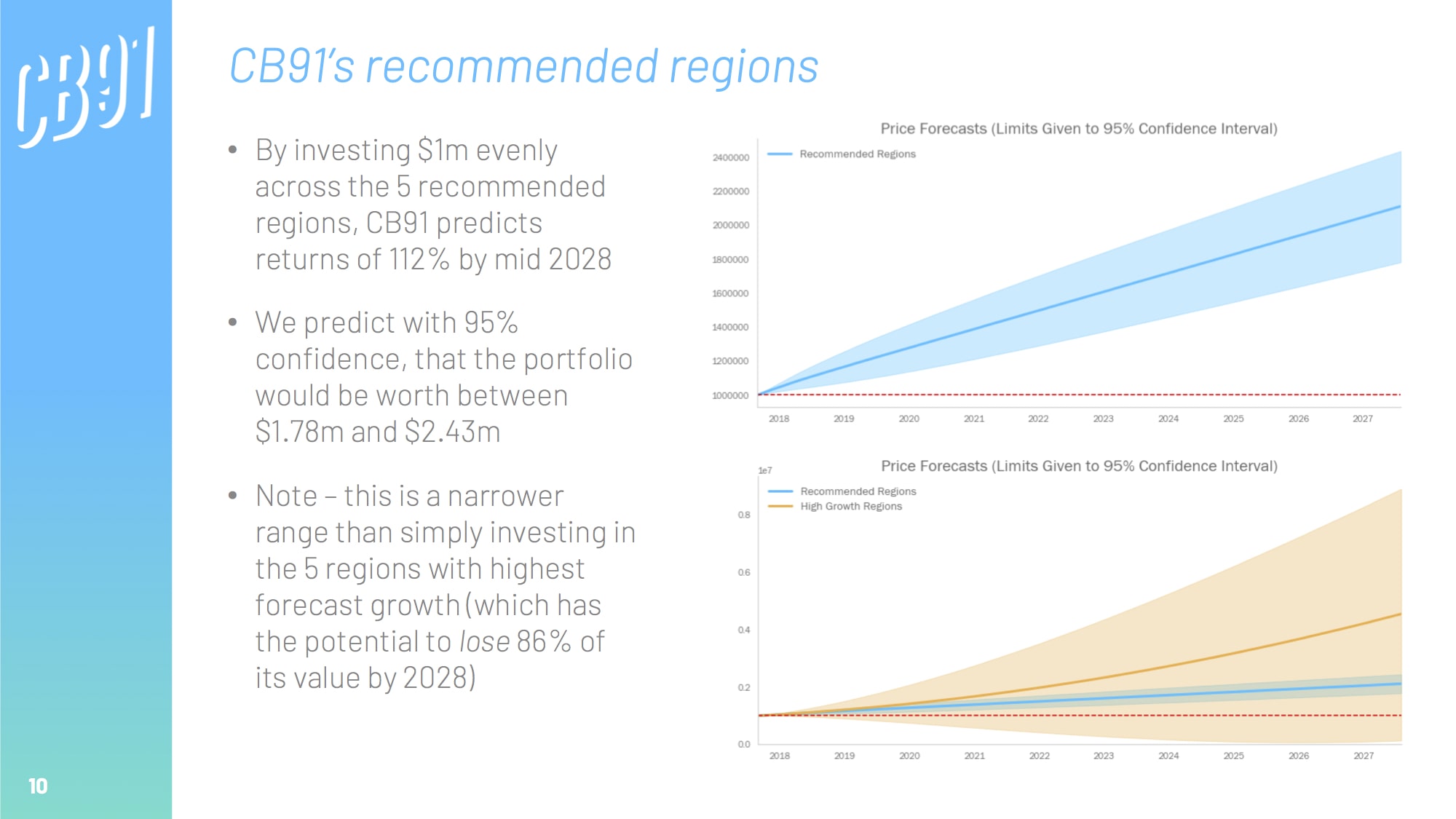

By investing $1m evenly across the five recommended regions (see presentation below) we predict returns of 112% by mid 2028. We predict with 95% confidence, that the portfolio would be worth between $1.78m and $2.43m.

the techniques

Analysis conducted using Python libraries and APIs:

- Pandas for data munging

- Statsmodels for ARIMA modeling

- Matplotlib and Geopandas for data visualisation

the GitHub repo

View the readme on the project's GitHub repo for a full breakdown of the project.

the findings

This presentation was created to be presented to a non-technical audience in under 10 minutes.

the blog

"The aim of our analysis is a deceptively simple one — given historical data of the US housing market, which five regions would we recommend buying property in now, if the goal is to get as large a return on our investment as possible in, say, ten years?..."

Follow Callum Ballard on Towards Data Science

Follow Callum Ballard on Towards Data Science